In One Chart

Extra compensation offered if Boeing’s credit ratings fall into “junk” category

Boeing Co. returned to the borrowing trough on Thursday with a four-part bond deal, a day after reporting third-quarter results that weren’t as bad as Wall Street feared though they highlighted the embattled aircraft maker’s significant cash burn.

Bankers and investors still need to haggle over the ultimate size and price of Boeing’s BA, -3.10% new debt financing, but order books for the transaction already have reached about $12 billion on what could end up being at least a $4 billion pile of fresh corporate debt, according to an investor monitoring the transaction.

Boeing said in a public filing Thursday that it may use proceeds from the bond sale to repay near-term debts. The company had $3.6 billion of short term debt due, according to a report from CreditSights.

Pushing out maturing debts into the future has been a lifeline for cash-strapped U.S. corporations hard-hit by the pandemic, with air travel still almost 70% below levels seen before the pandemic.

In addition to announcing more staff cuts, Boeing on Wednesday also reported that it burned through $5.1 billion of free cash flow in the third quarter, or less than its $5.6 billion cash burn in the second quarter, as the company continues to grapple with the economic toll of the pandemic and its still grounded 737 Max fleet program.

Boeing assumes that passenger air traffic will return to 2019 levels in about three years, even as Europe and parts of the U.S. battle once again with record COVID-19 cases.

Initial price guidance on its new bonds ranged from a spread of 195 basis points above Treasurys TMUBMUSD10Y, 0.856% for its 3-year class to 300 basis points above the risk-free benchmark for its longest 10-year parcel, according to Ashwin Tiruvasu at CreditSights. Those levels often move with investor demand.

Spreads are the level of compensation investors earn on bonds above a risk-free benchmark, with increasing spreads often pointing to a riskier asset or market tone.

U.S. stocks were on the climb Thursday after Wednesday’s rout left the Dow Jones Industrial Average DJIA, -1.46% down 943 points.

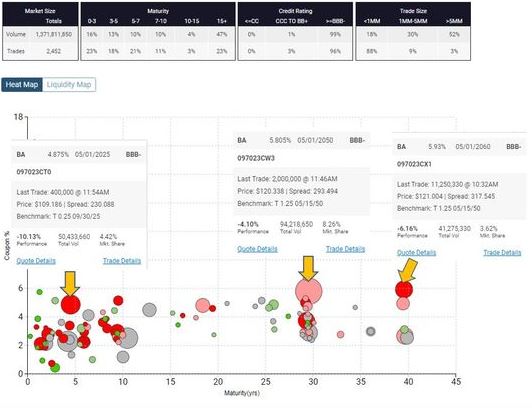

In the bond market, Boeing’s debt was under pressure and among the most actively traded of the Dow’s 30 companies on Thursday, even when looking at debt maturing in five years, 30 years and beyond, according to BondCliq data.

Boeing bonds under pressure BONDCLIQ

Tiruvasu at CreditSights said that Boeing bond’s initial price levels likely weren’t enough to “fully compensate investors” for the risk of the company’s credit ratings being downgraded to “junk” or the speculative-grade category.

Fitch Ratings cut Boeing’s corporate debt ratings one notch to BBB- from BBB, with a negative outlook on Thursday, effectively putting the debt on the cusp of falling into the junk category. The credit rating firm pointed to a “prolonged recovery from the pandemic” compared with Fitch’s “original expectations,” as well as the challenges to Boeings financial metrics due to its grounded 737 Max operations, as forming its rationale.

Like Boeing’s prior bond deal in April, the new bonds will offer investors concessions if the debt loses its coveted investment grade ratings. Specifically, investors in the new bonds would earn another 25 basis points of additional spread per each ratings notch cut by Moody’s Investors Service below its current Baa2 level or S&P Global’s BBB- grades, the cusp of junk territory.