Moneyball for Bonds Aims to Rank Traders Baseball Card-Style

By-

BondCliQ to use stats to shed light on trader performance

-

Paul DePodesta, who remade Oakland A’s with stats, is involved

Wall Street bond traders may soon be immortalized in the fashion of baseball legends Honus Wagner, Willie Mays and Pete Rose if a plan by a former Goldman Sachs Group Inc. executive takes off.

That’s right, baseball cards are coming to finance.

The brainchild of Chris White, founder of bond trading and analytics firm BondCliQ, the digital cards reflect a new statistical approach to measure the effectiveness of individual traders and salespeople on dealer bond desks. White brought in as an investor Paul DePodesta, who used novel statistical methods to elevate the Oakland Athletics baseball team to a title contender, a story captured in the Michael Lewis book “Moneyball.”

The bond market has historically leaned on one metric for success — did a trader make money? BondCliQ wants to shed some light on whether rainmakers are good or lucky. It is collecting data that can allow buyers such as hedge funds or other institutional investors to identify the best dealer traders in a given sector or security. And dealers can see how they rank among competitors. Presumably, traders who top the list year after year could use the stats to argue for better pay.

“Here we are in a market where data is king, but we have very little information on who is qualified,” White, the firm’s chief executive officer, said in an interview. “The buy side wants to know who they should engage. The dealers want an opportunity to show why it should be them.”

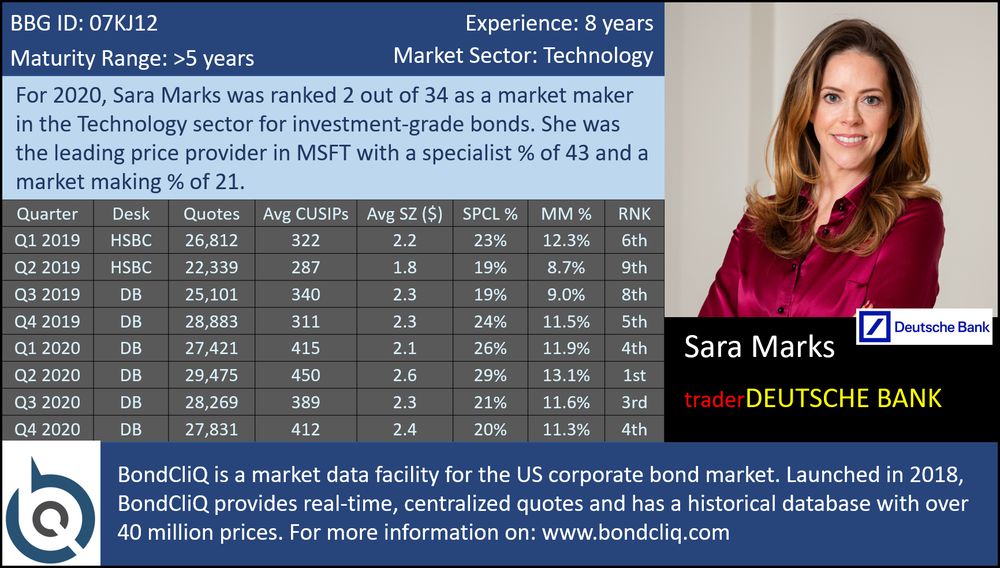

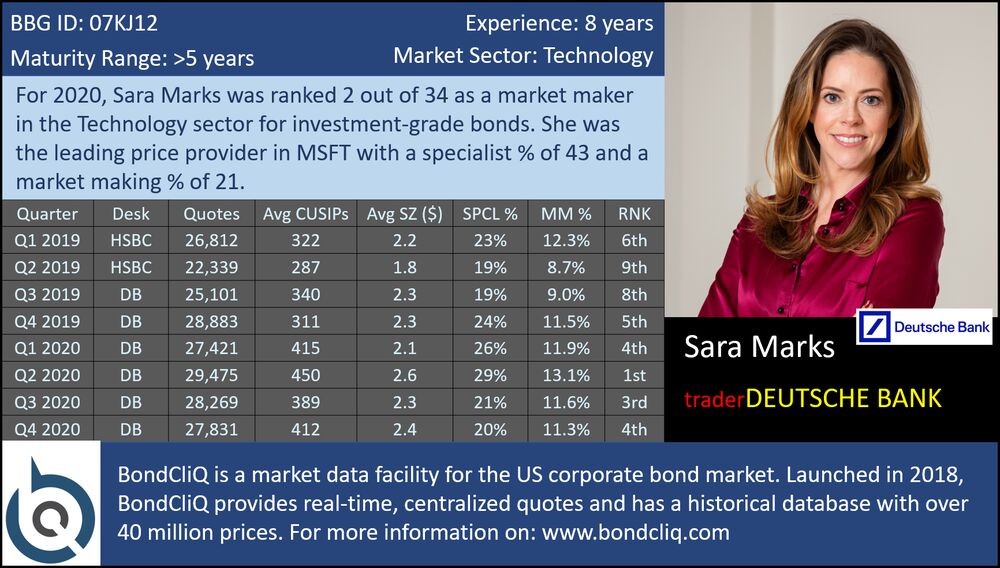

The data will include market sector, average maturity of debt bought and sold and the number of quotes provided, according to a mock card provided by White. The firm will also calculate stats called specialist percentage and market-maker percentage.

The specialist percentage is “when you make a price that’s normally the best price in the market,” White said. The market-maker stat denotes traders who “are the market,” he said. The end goal is to create better bond prices by putting both individual and bank reputations on the line.

The effort comes as the market is bigger and perhaps riskier than it’s ever been. U.S. investment-grade companies have sold more than $1 trillion in new corporate debt in each of the last eight years — and the fastest pace was set in 2020, when the mark was reached in May.

BondCliQ is creating a system to collect, maintain and publish stats on bond traders and salespeople by bank. It has 34 dealers that voluntarily provide pricing data, White said. The firm supplements that with some public information such as Trace-reported deal size and price to derive the stats.

Read more: Goldman alum touts ’70s era fix to bond market’s big problem

White was at Goldman Sachs from 2010 to 2015, where he created GSessions, a bond-trading system that has since been shut down. He’s also CEO of advisory firm ViableMkts LLC.

Bloomberg LP, the parent of Bloomberg News, competes with BondCliQ in providing bond-price information.

DePodesta joined the Oakland A’s as an assistant to general manager Billy Beane in 1999 and was general manager of the Los Angeles Dodgers from 2004-05. Now the chief strategy officer for the National Football League’s Cleveland Browns, he said in an interview that he was attracted to BondCliQ by the chance to bring a systemic organizing approach to the market.

“What we were able to do in baseball is aggregate a lot of the data to better understand the world we were operating in,” he said. “I saw the same opportunity here but on a much greater scale.”

DePodesta said he’d assumed there was a certain level of price transparency in the bond market, but there isn’t.

‘Can’t Believe This’

“With each conversation there was almost an ‘I can’t believe this’ moment — this is the way it’s done?” he said. If a bond desk makes $500 million a year “is that good?” he said. “Should that have been $1 billion or should it have been $2 million and they hit it out of the park?”

DePodesta said the use of stats to improve bond-trading performance will mirror his experience in professional sports, which was part of the inspiration for Jonah Hill’s character in the movie adaptation of Lewis’s book.

“It’s a march to the inevitable here. It was the same with baseball, it’s the same with football,” he said. “The need is so overwhelming you won’t be able to resist it.”

White wants BondCliQ to show bond traders how they stack up against counterparts at other banks so that pricing improves across the board. He said his firm will send report cards to dealer-desk heads by the end of this month and the rankings will be visible to buy-side clients in early July.

“Dealers really want to compete for order flow,” he said. “The best way to compete is if there’s more data around performance.”

— With assistance by Dan Wilchins